The 10-Minute Rule for Paul B Insurance

There seemed to be a little less passion in add-on special needs and life insurance offerings last yearperhaps reflective of the hyper-focus on all points wellness related (whether staff members' own wellness or their family pets'!), Buckey adds. She claims she had to laugh when she saw that family pet insurance has actually moved up to the 4th area on the checklist.

Examine This Report about Paul B Insurance

Out of workers that received repayments, 71% of their allowance was utilized, leaving the continuing to be 29% with the employer. Employers that have actually provided a QSEHRA considering that 2017 given 26% even more in allowances than employers who began offering a QSEHRA through People, Maintain in 2021. Paul B Insurance. The QSEHRA is the initial wellness benefit used to staff members for virtually 9 out of 10 companies.

Health care benefits are typically optional for smaller sized companies however are of critical value to the majority of staff members. Companies of all dimensions should be aware of the pros as well as disadvantages of using wellness advantages to their staff members. Advantages are a vital item of a worker payment bundle, as well as healthcare advantages are the crown jewel. Paul B Insurance.

Every employer must a minimum of consider whether to offer these types of benefits and in some instances, companies have to use wellness treatment in order to stay competitive with other organizations for the most gifted staff members and also prevent charges imposed check this site out by healthcare reform. One more factor why several employers choose to use healthcare benefits is to make sure that they themselves can benefit from less costly health and wellness insurance coverage than they could hop on their very own as well as tax obligation breaks for the contributions made by the organization.

6 Easy Facts About Paul B Insurance Explained

In Hawaii, all companies need to supply Prepaid Wellness Care Act insurance coverage to their eligible employees in Hawaii, regardless of whether they are full-time or part-time, irreversible or temporary, as long as they are not in an omitted classification. On top of that, having employees in another state (whether onsite or functioning from residence) can set off various other compliance responsibilities.

If workers don't get preventative treatment and yearly physicals (which they might not do if they don't have insurance coverage), you might finish up having more workers out for extended periods of time with serious illnesses. There can be a downside to providing wellness advantages, also. A few of the cons of providing wellness benefits are:.

Even though the insurance provider from whom you buy the medical insurance will normally act as strategy manager, you will certainly have to choose the insurance company and afterwards invest component of your time filling out types, paying premiums, as well as acting as intermediary in between staff member and insurance company, amongst lots of other jobs. Tiny services might experience greater rates of staff member turnover This Site compared to larger services, leading to increased management costs associated to managing employee enrollments and terminations in wellness insurance plans.

The Ultimate Guide To Paul B Insurance

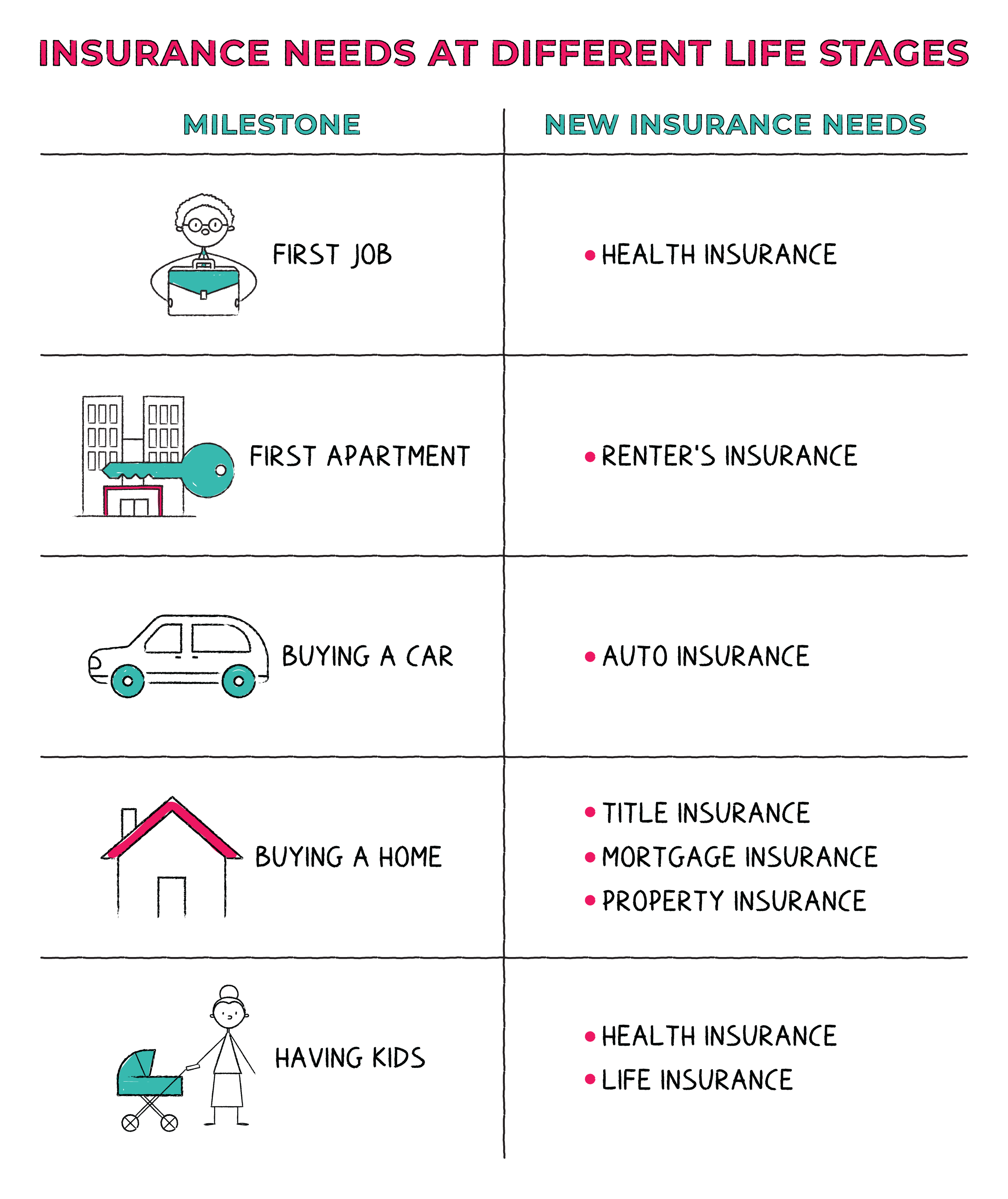

There's a precise convenience in knowing that also if your health and wellness takes an unexpected turn, you and also your family have a financial security web. When money's tight, however, paying for both a see this site life insurance coverage policy as well as medical care protection monthly can obtain challenging. As expenditures begin to mount, it can be alluring to go down one or the other to make ends fulfill.

Paying a premium for health insurance policy on a monthly basis simply appeared unneeded to some. With the ACA enforcing a required on many Americans to have health coverage, that began to alter. The Tax Obligation Cuts and Jobs Act (TCJA) got rid of the required (or, a lot more strictly speaking, the noncompliance penalty), starting in 2019.

The Paul B Insurance Diaries

5% of income vs. 9. 83%, and increases aids to lower-income consumersthose with earnings between 100% and also 400% of the hardship level. If you take place to stay in a state that chose to expand Medicaid as an outcome of the ACA, you could also be able to obtain protection through that program.

The same concept relates to family members that aren't covered at the office and rather get on the private market. Unless you expect to incur significant clinical costs, a "Silver" strategy can sometimes give you sufficient insurance coverage for much less than a "Gold" or "Platinum" one. Along with health and wellness coverage, the majority of individuals really do require life insurance coverage once they have a family.

:max_bytes(150000):strip_icc()/Best-oils-for-dry-skin-5187203-DD-V2-7c7303cb9ace48b68a449c90ad4d3f7c.jpg)